2022 Global Logistics: Is This the New Normal?

2022-09-20

2022-09-20

113

113

Logistics in News

U.S. Logistics Assistance Network Activated by Hurricane Ian National average diesel prices fell 7.5 cents to $4.889 as EIAMerge reportedly uses DAT for rate benchmark Q&A for its Emerge Dynamic RFP platform: Forward AirHutcheson CEO Tom Schmitt officially appointed FMCSA administrator More Logistics News

Over the past year, global supply chain disruptions, port congestion, capacity shortages, rising shipping rates and the ongoing pandemic have posed challenges for shippers, ports, carriers and logistics providers.

Looking ahead to 2022, experts estimate that the pressure on global supply chains will persist-and the dawn at the end of the tunnel will not appear until the second half of the year at the earliest.

Most importantly, the market generally believes that the pressure on the shipping market will continue in 2022, and the freight rate is unlikely to fall back to the level before COVID.Capacity problems and congestion at ports will continue to be combined with strong global demand in the consumer goods industry.

German economist Monika Schnitzer expects the current Omicron variant to have a further impact on global shipping times in the coming months."This could exacerbate delivery bottlenecks that already exist," she warned."Shipping times from China to the United States have increased from 85 days to 100 days due to the Delta variant and are likely to increase again.Europe is also affected by these issues because the situation remains tense. "

Meanwhile, the ongoing pandemic has caused congestion at major ports on the west coast of the United States and China, meaning hundreds of container ships are waiting for berths at sea.At the beginning of this year, Maersk had warned customers that the waiting time for container ships to unload or pick up goods at Long Beach Port near Los Angeles was between 38 and 45 days, and the restrictions were expected to last.

Alphaliner confirmed that MSC overtook Maersk to become the world's largest carrier of Container.Photo courtesy of MSC

Looking at China, there are growing fears that the recent Omicron breakthrough will lead to further port closures.

Tianjin port was locked down after a local outbreak in Omicron-less than a month before the opening of the Winter Olympics in nearby Beijing, state broadcaster CCTV reported in January.Chinese authorities temporarily blocked Yantian port and Ningbo port last year.

The restrictions have led to delays for truck drivers in moving full and empty Container between factories and ports, and disruptions in production and transportation have led to delays in exporting and returning empty Container to factories overseas.

In Rotterdam, Europe's largest seaport, congestion is also expected to continue until 2022.Although there are currently no ships waiting outside Rotterdam, storage capacity is limited and connections in the hinterland of Europe are not running well.

Dachser provides additional capacity through its air transport network connecting the United States, Europe and Asia.Photo courtesy of Dachser

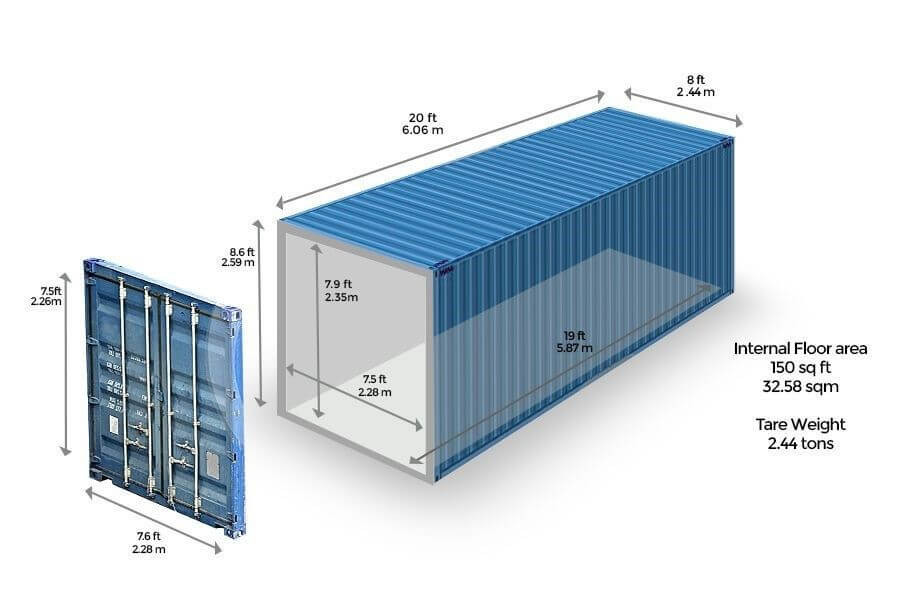

"By 2022, we expect extreme congestion in Rotterdam Container to continue temporarily," said Emile Hoogsteden, commercial director of Rotterdam Port Authority."This is because the growth rate of international container fleet and terminal capacity is not commensurate with demand."Still, the port announced in December that its trans-shipment volume exceeded 15 million 20-foot TEU (TEU) Container for the first time.

"At Hamburg Port, its multi-function and bulk terminal operations are operating normally, with Container operators providing 24/7 services," said Axel Mattern, CEO of Hamburg Port Marketing."Major players at the port are working to eliminate bottlenecks and delays as quickly as possible."

Late ships that Hamburg Port can't affect lead to exports to Container sometimes piling up at the port terminal.The terminals, freight forwarders and shipping lines involved are aware of their responsibility for smooth operation and work within the scope of possible solutions.

China's busiest port, Ningbo Zhoushan Port in eastern Zhejiang Province, has a record cargo throughput of 1.2 billion tons in 2021. Photo provided by Tang Jiankai

Good times for operators

At the same time that shippers are under pressure, 2021 has been a prosperous year for Container carriers.Ten leading publicly listed Container shipping lines are on track to make record profits of between $115 billion and $120 billion in 2021, according to projections by shipping intelligence provider Alphaliner. The windfall could change the industry structure as those gains last month, Alphaliner analysts said, were all reinvested.

The sector has also benefited from a rapid recovery in production in Asia and strong demand in Europe and the United States.Seaborne rates nearly doubled last year due to a shortage of capacity in Container, while early forecasts suggest freight rates could reach even higher levels in 2022.

Data analysts at Xeneta report that the first contracts in 2022 reflect record high levels going forward."When will it end?"Asked Patrik Berglund, CEO of Xeneta."Shippers hoping for some much-needed freight relief have been crushed by another round of heavy blows to bottom-line costs.Continuing perfect storms such as high demand, capacity maximization, port congestion, changing consumer habits and widespread supply chain disruption are fueling freight surges, and frankly we have never seen anything like that. "

Container, the world's leading carrier, has also changed its ranking at the top of the list.Mediterranean Shipping Line (MSC) has overtaken Maersk to become the world's largest Container shipping line, Alphaliner reported in its January Global Seaborne Fleet Statistics.

MSC currently operates a fleet of 645 container ships with a total capacity of 4,284,728 TEU, while Maersk has a total capacity of 4,282,840 TEU (736 ships) and is in the leading position with a capacity of nearly 2,000 ships.Both companies hold 17% of the global market share.

French carrier CMA CGM, with a capacity of 3,166,621 TEU, regained the third place from COSCO (2,932,779 TEU) and now ranks fourth, followed by Hapag-Lloyd (1,745,032 TEU), which is newly ranked fifth. However, for Maersk CEO S ø ren Skou, losing the top position does not seem to be a big problem.

In a statement issued last year, Skou said, "Our goal is not to be number one. Our goal is to do a good job for our customers, provide considerable returns, and most importantly, become a stakeholder in the company doing business with Maersk that everyone else is decent."He also mentioned that the company pays great attention to expanding its logistics capacity with higher profit margins.

Global participants are expanding

To achieve this goal, Maersk announced in December that it would acquire Headquarters's LF Logistics in Hong Kong to expand its coverage and logistics capacity in the Asia-Pacific region.The $3.6 billion all-cash deal is one of the largest acquisitions in the company's history.

Global ports group PSA International has expanded its logistics capabilities to provide end-to-end supply chain services.Photo courtesy of PSA International

Headquarters's Singaporean-based PSA International Pte Ltd (PSA) announced another big deal this month.Ports has signed a deal to buy a privately held 100% stake in BDP International, Inc. (BDP) from Headquarters's New York-based private equity firm Greenbriar Equity Group, LP (Greenbriar).BDP Headquarters, based in Philadelphia, is a global provider of integrated supply chain, transportation and logistics solutions.With 133 offices around the world, it focuses on managing highly complex supply chains and high care logistics as well as innovative visibility solutions.

Tan Chong Meng, CEO of PSA International Group, said, "BDP will be the first major acquisition of this nature by PSA-a global integrated supply chain and transportation solution provider with end-to-end logistics capability.Its advantages will complement and expand PSA's ability to provide flexible, resilient and innovative freight solutions.Customers will be able to benefit from the broad functionality of BDP and PSA while accelerating their transition to a sustainable supply chain. "The transaction is subject to the formal approval of the relevant authorities and other customary closing conditions.

The New Giant on the Horizon

In December, the listing of China Logistics Group, a new logistics giant in China, attracted wide attention.

The new company, with a registered capital of about $4.7 billion, is a merger of five state-owned companies, including China Railway Materials, according to Reuters and state broadcaster CCTV;China Material Storage and Transportation Group;

Huamao International Freight Co., Ltd. Shenzhen Branch;China Logistics;China National Packaging Corporation.

The State-owned Assets Supervision and Administration Commission (SASAC) and China Chengtong, a state-owned investment company, each hold 38.9%.Strategic investors include China Eastern Airlines, COSCO Shipping and China Merchants Group, holding 10%, 7.3% and 4.9% shares respectively.

The new logistics group will provide a wide range of logistics services, including warehousing, distribution, packaging, Multimodal and cross-border electronic commerce.

There are 120 special railway lines connecting Asia and Europe, 42 warehouses and other storage facilities covering 4.95 million square meters, and a transportation network covering 30 provinces and five continents, CCTV reported.

Through the new logistics group, China will strengthen its cross-border logistics business and Multimodal services.The move also reflects China's rivalry with existing global logistics operators, who are sure to keep an eye on developments.

Freight forwarders increase transportation capacity

In response to the continuing demand for increased transport capacity, international freight forwarders have introduced new services between Europe, the United States and Asia.

In December, Maersk acquired Headquarters's Hong Kong-based contract logistics company, LF Logistics.Photo courtesy of Lifu Logistics

In 2021, Jorda, a French logistics supplier, rented the first freighter to alleviate the shortage of capacity in Container on the Asia-Europe route, and then launched the self-rented brand A330-300 full cargo plane to upgrade the AirDirect service between Europe, the United States and Asia.The aircraft operates between Amsterdam, London, Chicago and Hong Kong, and also serves the Central European route in peak season.

"As air transport capacity continues to be tight, we want to ensure a more sustainable supply of air transport space for our customers, so we are investing in this first dedicated cargo plane of our own," said Marie-Christine Lombard, CEO of Jorda.

DACHSER USA, a subsidiary of Dachser, a global logistics provider, also proved the return of using its own leased aircraft to provide autonomous air transport services.Since its weekly transatlantic freight service began between Frankfurt and Chicago in 2020, it has grown by more than 85% of U.S. customers using the service between Europe and the U.S. more than once.

"This route has proven to be a very reliable and efficient solution that has become the cornerstone of our global air transport service network," said Andy Frommenwiler, vice president of U.S. air transport at DACHSER.

Air transportation is under pressure

The tight supply chain after the pandemic is also increasingly affecting the growth of air transportation.According to the global air cargo market data released by the International Air Transport Association (IATA), the growth slowed down in November 2021.

While economic conditions remain favourable for the sector, supply chain disruptions and capacity constraints have affected demand.As the impact of COVID-19 distorted comparisons between monthly results in 2021 and 2020, comparisons were made with November 2019, which followed normal demand patterns.

According to IATA data, global demand measured in cargo ton-kilometer (CTK) increased by 3.7% compared with November 2019 (4.2% for international operations).This is significantly lower than the 8.2 pc growth rate in October 2021 and the previous months (2pc for international business).

While economic conditions continue to support air cargo growth, supply chain disruptions are slowing growth due to labor shortages, partly due to staff quarantines, insufficient storage space at some airports and year-end peaks exacerbating processing backlogs.

Several major airports, including New York's JFK International Airport, Los Angeles and Amsterdam's Schiphol Airport, have reported congestion.However, retail sales in the United States and China remain strong.In the US, retail sales are 23.5% higher than November 2019 levels, while in China, online sales on Singles Day are 60.8% higher than 2019 levels.

In North America, air cargo growth continues to be driven by strong demand.Airlines there saw an 11.4% increase in international cargo volume in November 2021 compared to November 2019. This is much lower than the table in October Now (20.3%).Supply chain congestion at several major U.S. freight hubs has affected growth.International capacity decreased by 0.1% compared with November 2019.

European airlines saw an increase of 0.3% in international cargo volume in November 2021 compared to the same month in 2019, but this was a significant drop from October 2021 (7.1%).European carriers have been hit by supply chain congestion and local capacity constraints.

Compared with pre-crisis levels, international capacity fell by 9.9% in November 2021, while capacity on major Eurasian routes fell by 7.3% during the same period.

In November 2021, the international air cargo volume of Asia Pacific Airlines increased by 5.2% compared with the same month in 2019, only slightly lower than the 5.9% increase last month.The region's international capacity slowed slightly in November, falling 9.5% compared to 2019.

There is a lot of work to be done

It is clear that the pandemic has exposed the fragility of global supply chains-a problem that the logistics industry will continue to face this year.The high degree of flexibility and close cooperation between all parties in the supply chain requires full preparation for the crisis and hopefully for the post-COVID era.

Investment in transportation infrastructure, such as large-scale investment in the United States, is helping to improve the efficiency of ports and airports, and digitalization and automation are also important to further optimize logistics processes.

However, don't forget human factors.The shortage of labor-not just truck drivers-shows that efforts are still needed to maintain the logistics supply chain.Reorganizing the supply chain to make it sustainable is another challenge.

The logistics department still has a lot of work to do, which undoubtedly proves its ability to provide flexible and creative solutions.